It's Sunday night again. You're back at your laptop, scrolling through Apollo, trying to find 100 more prospects to email tomorrow. Your last batch got a 1.2% reply rate. The agency you fired last month blamed your ICP. Your co-founder is asking about pipeline. And you're wondering if you should just accept that outbound "doesn't work anymore."

Here's what's actually happening: you're solving the wrong problem.

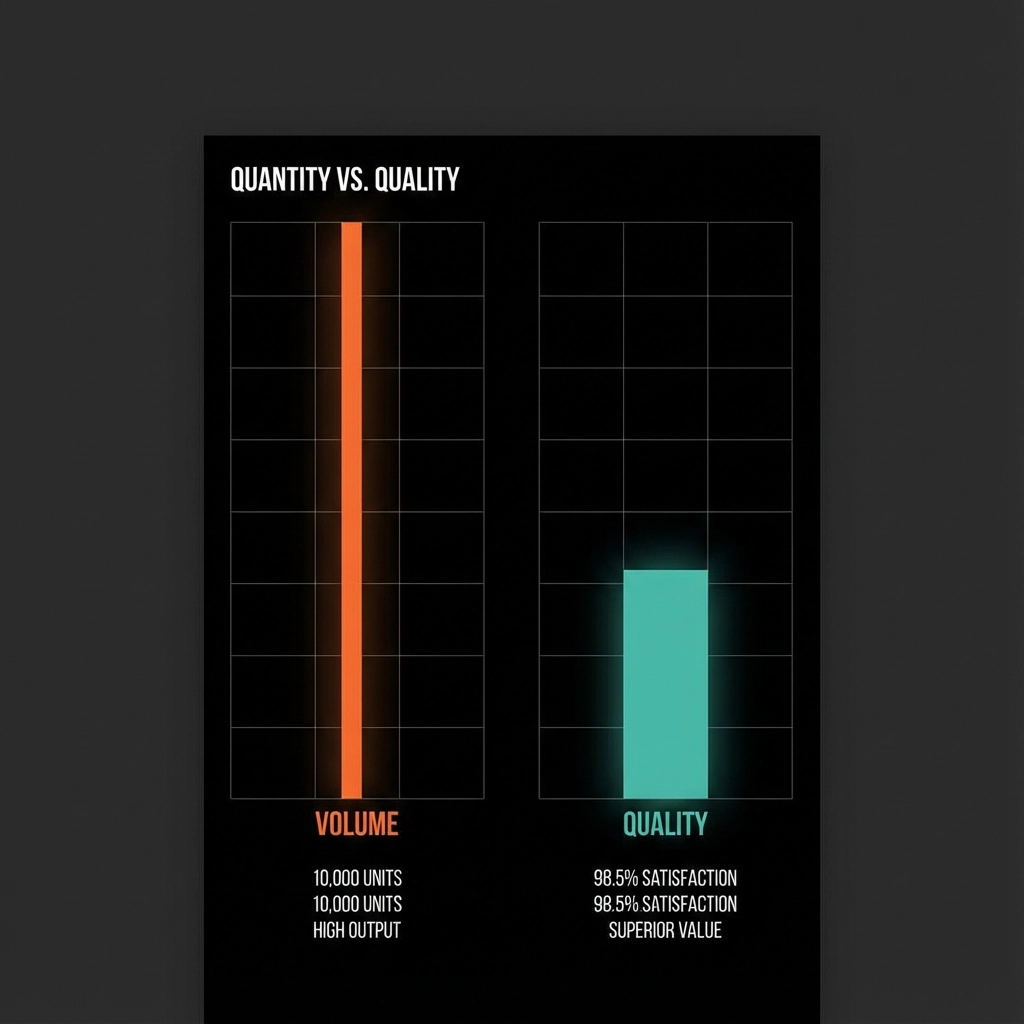

Most founders treat outbound like a numbers game. Send more emails. Hit more prospects. Scale the volume until something sticks. But the data tells a different story, and it explains why you're burning through Sunday nights instead of building your product.

The Volume Trap Every Founder Falls Into

The typical founder outbound playbook looks like this: buy a list of 10,000 contacts, write 3-4 generic email templates, set up a sequence, and blast away. When replies don't come, the obvious answer seems to be "more volume."

This approach fails for a simple reason: 86% of B2B companies rely on outbound to hit their numbers, but 53% say it's not working. The problem isn't that outbound is broken. The problem is that most outbound is research-poor and volume-heavy.

The math here is brutal for early-stage founders. If you're sending 500 emails per week with a 1-2% reply rate, you're getting 5-10 replies. Maybe 1-2 turn into demos. Maybe 1 of those closes in the next 6 months. You just spent 20+ hours per week for one deal.

Meanwhile, you're not shipping features. You're not talking to users. You're not fundraising. You're becoming a full-time SDR for your own company, and it's the least scalable thing you could possibly do.

Why Research Changes Everything (And Most Founders Skip It)

Here's a number that should change how you think about outbound: sales reps who conduct consistent pre-call research achieve 50% higher quota attainment than those who don't.

50%. That's not a small optimization. That's the difference between hitting your numbers and missing them entirely.

But research feels slow when you're in founder mode. Opening LinkedIn profiles, reading company blogs, finding recent funding announcements, figuring out tech stack, it takes 15-20 minutes per prospect. For a list of 100 prospects, that's 25-30 hours of research before you send a single email.

Most founders skip this step because it doesn't scale. You can't research 500 prospects per week and still run a company. So you default to templates and pray for volume to save you.

The Real Math Behind Founder Burnout

Let's break down what "doing outbound right" actually costs in founder time:

The Volume Approach:

- List building: 2 hours

- Email writing: 1 hour

- Sending/managing: 2 hours per week

- Follow-up sequences: 1 hour per week

- Total: 6 hours/week, 1-2% reply rate

The Research Approach:

- List building: 4 hours (better targeting)

- Research per prospect: 15 minutes × 50 prospects = 12.5 hours

- Personalized email writing: 5 minutes × 50 prospects = 4 hours

- Sending/managing: 2 hours per week

- Follow-up sequences: 2 hours per week

- Total: 24.5 hours/week, 8-12% reply rate

The research approach works 4-6x better. But it requires 4x more time. For a founder already working 70-hour weeks, that extra 18 hours has to come from somewhere. Usually, it comes from product development, user research, or sleep.

This is why most founders either burn out on outbound or give up entirely. The thing that works requires more time than they have.

What Research-First Outbound Actually Looks Like

When you flip from volume to research, everything changes. Instead of "spray and pray," you're building a system around understanding each prospect before you reach out.

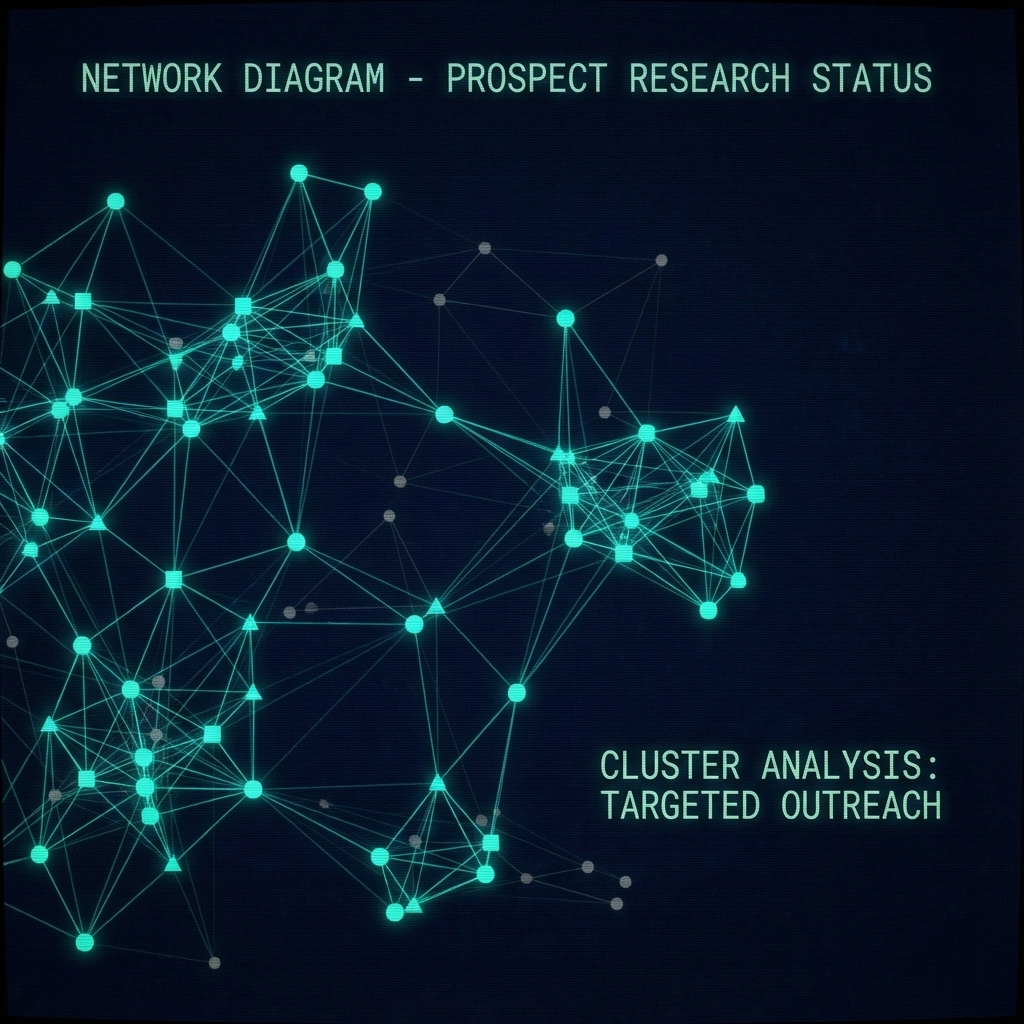

Step 1: Deep ICP Research

Not just "marketing directors at SaaS companies," but "marketing directors at Series A SaaS companies who just raised funding and are probably hiring their first demand gen person." That level of specificity comes from research, not from buying bigger lists.

Step 2: Individual Account Research

Recent funding rounds, new hires, product launches, tech stack changes, competitive losses. You're looking for moments when your solution becomes relevant, not just when your prospect exists.

Step 3: Trigger-Based Messaging

Your email isn't about your product. It's about their specific situation right now. The funding they just raised. The competitor who just landed their biggest prospect. The engineer they just hired who's going to need the thing you built.

This approach gets 8-12% reply rates because you're reaching out when it actually matters, with something that actually applies to their world right now.

The Hidden Cost of DIY Research

Here's the part most founders don't calculate: the opportunity cost.

Every hour you spend researching prospects is an hour you're not:

- Building features your paying customers need

- Talking to users about what's broken

- Working on your fundraising deck

- Sleeping (which affects everything else)

If your time as a founder is worth $200-500/hour (based on your eventual exit value), spending 25 hours per week on prospect research costs your company $5,000-12,500 in opportunity cost. Every week.

At that rate, you could hire a full-time SDR in 6-8 weeks. But most early-stage founders don't have $80-120K in cash for an SDR who'll take 3 months to ramp and might quit after 18 months.

This is the chicken-and-egg problem every founder faces: you need pipeline to raise money, but you need money to build pipeline properly.

What Changes When Research Happens Automatically

The solution isn't to skip research or hire expensive headcount you can't afford. It's to automate the research while keeping human judgment in the loop.

Imagine this workflow:

- Your system identifies prospects who match your ICP and are showing buying signals

- It researches each prospect automatically: recent news, funding, hiring, tech changes

- It drafts personalized emails based on that research

- You approve each email before it sends (keeping your voice and quality control)

- Follow-ups happen automatically, but you control the messaging

This gives you research-quality outbound without research-level time investment. You're still approving every email, so quality stays high. But you're not spending 15 minutes per prospect on LinkedIn research.

The $499 vs $100K Math

Most founders think their options are: do it themselves (and burn out) or hire an SDR (and go broke). But there's a third option that changes the economics entirely.

Full-time SDR costs:

- Salary: $60-80K

- Benefits/taxes: $15-20K

- Tools/training: $5-10K

- Ramp time: 3 months before productivity

- Turnover risk: average 18-month tenure

Total loaded cost: $80-120K per year, plus 3-6 months of founder time to hire and train

Compare that to a system that handles the research automatically, drafts emails in your voice, and lets you approve everything before it sends. Cost: $499/month. No ramp time. No turnover risk. You keep control but get back your Sundays.

The math is simple: research-driven outbound works, but it doesn't scale with human labor. Automate the research, keep the human judgment, solve the chicken-and-egg problem.

If you're tired of choosing between burning out on outbound and burning cash on headcount, there's a better way. Ramen handles the research and drafting so you can focus on approving great emails instead of writing mediocre ones. Your pipeline grows, your Sundays stay free, and your product development doesn't suffer.